Renters Insurance in and around Humble

Your renters insurance search is over, Humble

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

You have plenty of options when it comes to choosing a renters insurance provider in Humble. Sorting through coverage options and deductibles to pick the right one can be overwhelming. But if you want reasonably priced renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy unmatched value and no-nonsense service by working with State Farm Agent Travis Davis. That’s because Travis Davis can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including videogame systems, furnishings, sports equipment, tools, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Travis Davis can be there to help whenever trouble knocks on your door, to help you submit your claim. State Farm provides you with insurance protection and is here to help!

Your renters insurance search is over, Humble

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

You may be wondering: Do you really need renters insurance? Imagine for a minute what would happen if you had to replace your stuff, or even just a few high-cost things. With a State Farm renters policy in your corner, you won't be slowed down by abrupt water damage from a ruptured pipe. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've placed in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Travis Davis can help you add identity theft coverage with monitoring alerts and providing support.

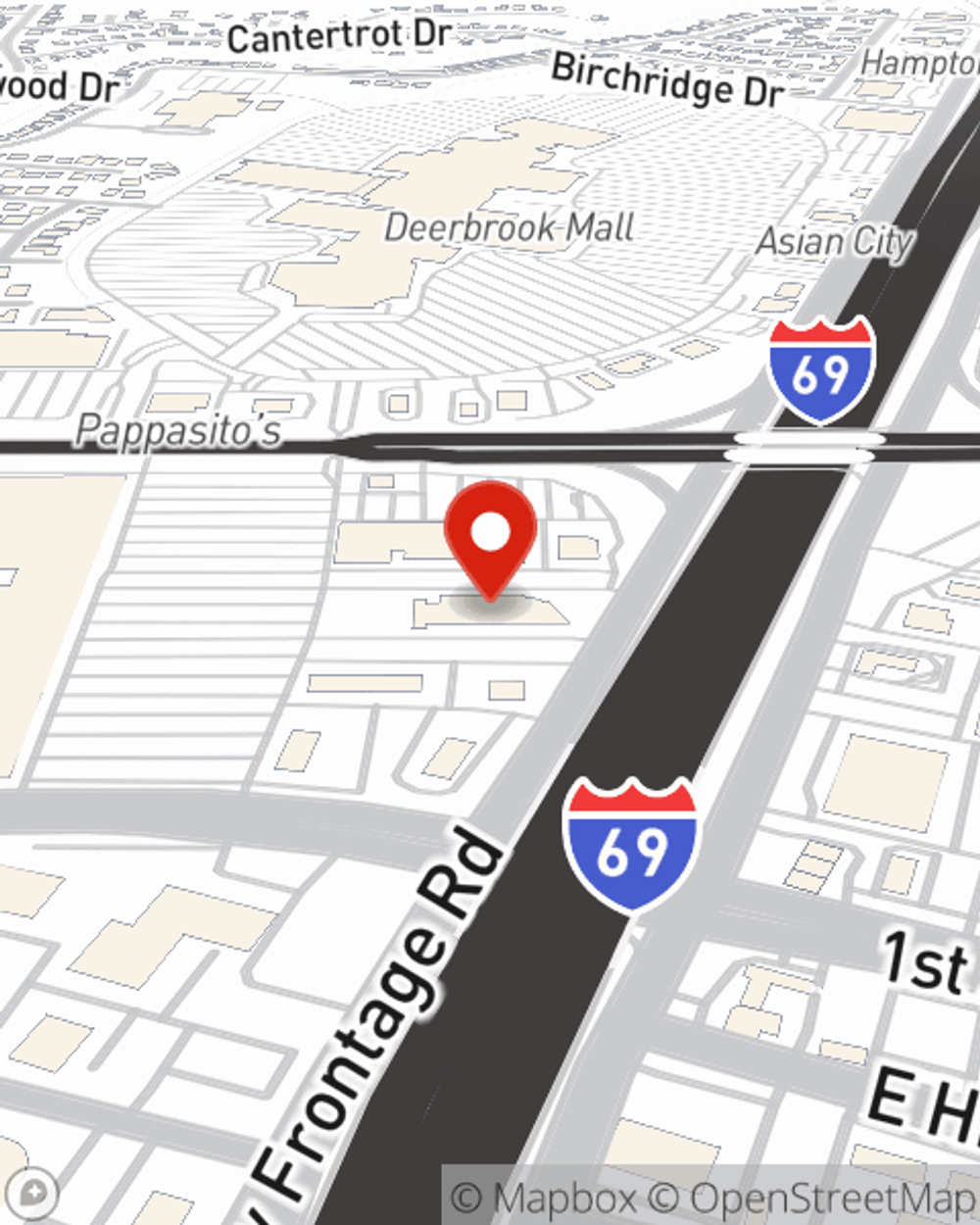

As a value-driven provider of renters insurance in Humble, TX, State Farm helps you keep your valuables protected. Call State Farm agent Travis Davis today and see how you can save.

Have More Questions About Renters Insurance?

Call Travis at (281) 540-4600 or visit our FAQ page.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Travis Davis

State Farm® Insurance AgentSimple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.